Steel Price Projections 2025-2026

Steel Price Forecasts

The note below considers near- and medium-term steel price forecasts - that is, the outlook for world steel prices in 2025 and beyond. The forecasts for 2026+ are available for purchase.

Price Cycle Analysis

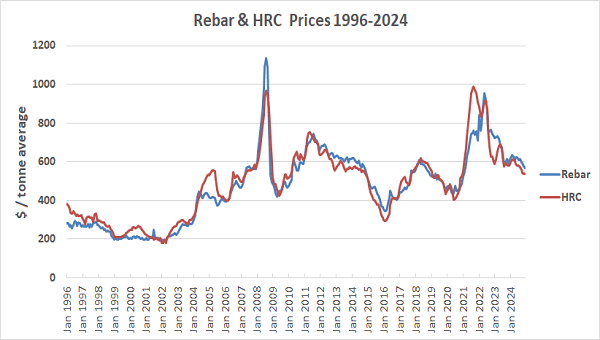

A notable characteristic of world steel prices is that they are highly cyclical. As can be seen in the chart below, prices move from peak to trough every few years. Looking at pricing for typical steel products such as hot rolled coil (HRC) or reinforcing bar, the latest price peaks occurred in August 2011, April 2018 and Q4 2021 / Q1 2022. Recent price troughs occurred in May 2009, February 2016 and June 2020. Across these products, the average peak-to-peak or trough-to-trough time over the last 25 or so years works out at ~3-4 years. In our view, the next price peak can be expected in 2027. We also forecast that the next pricing trough will occur in mid-2025 (but see below).

It is MCI's view that - at the time of writing (February 2025) - international steel prices still appear to be declining, dropping from an end-2021 / early 2022 high. Other independent observations appear to agree with this view of the steel market outlook, as discussed below.

Supply & Demand Outlook 2025

Another way to consider the pricing outlook is to consider future prospects for the global steel supply-demand balance. In this respect, it is noteworthy that:

- The World Steel Association (worldsteel) consider that global steel demand in 2025 will grow by 1.2% over 2024 levels (from ~1751 million tonnes finished products in 2024, to ~1772 million tonnes). This is equivalent to a 2025 increase in global steel consumption of ~21 million tonnes [See Worldsteel, Short Range Outlook October 2024].

- The OECD meanwhile [see Chairman's statement, 96th Steel Committee meeting reported that an additional 50 million metric tonnes (mmt) of new capacity will enter the market in 2024. This will bring world overcapacity to ~573 million tonnes. Even adjusting for yield losses from crude stel to finished steel (perhaps 10%), it is clear that the rate of supply growth (around 45 million tonnes) will easily outstrip the rate of steel demand growth (just 25 mt).

On this basis, we judge that year 2025 capacity utilisation is likely to fall below 2024 levels, leading to further near-term reductions in world steel prices.

Market Outlook and Price Forecasts

Taken together, MCI's judgement regarding the current level of steel prices in the context of the longer-term price cycle; with our assessment of expected changes to the steel supply demand balance in 2025 – all point to declining steel prices as year 2025 unfolds. The MCI projection therefore is that steel prices will continue to fall across Q1 / Q2 2025, reaching a trough around mid-2025 or end-2025. A gradual return to the next peak in the steel cycle in 2027 will then ensue. The phasing out of free allowances under the EU ETS starting in 2026 will accelarate this price recovery in Europe.

Quarterly Market Updates

Q3 2024 update

In August 2024, Baowu Steel's Chairman Hu Wangming warned staff of harsh market conditions that were proving longer and more difficult to endure than previously expected, as China's property downturn shows no sign of recovery. Shipments from China are on track to reach ~100 million tonnes in 2024 as producers there scramble to offset the domestic slowdown; and are likely to depress international steel prices for some months to come. Other recent press reports also express concern about the current steel industry downturn noting that the global impact of China's steel overproduction is becoming increasingly evident.

Q4 2024 update

Eurometal reported in early December 2024 that expectations of a rebound in European HRC prices the first quarter of next year was being tempered by a persistent lack of demand and by oversupply. See Hopes for European steel price rebound in early 2025. To MCI, this confirms the view that the bottom of the current steel cycle may not now occur until mid- to late-2025.

Q1 2025 update

Recent market indicators in early 2025 continue to support MCI's outlook for declining steel prices through most of the year. Chinese steel exports eventually reached 110 million tonnes in 2024, exceeding earlier projections of 100 million tonnes, and preliminary data suggests this trend is continuing in Q1 2025. Global steel capacity utilization rates have fallen below 75% in early 2025, compared to 77.3% in Q4 2024, indicating persistent oversupply conditions.

The property sector downturn in China shows no signs of meaningful recovery, with major developers continuing to face liquidity challenges. This is maintaining pressure on Chinese producers to redirect excess production to export markets. In Europe, while there have been some temporary price stabilisations due to restocking activities in January 2025, underlying demand remains weak, particularly in the construction and automotive sectors. The combination of these factors reinforces our projection that steel prices will likely continue declining until reaching a trough in mid- to late-2025. The announcement on 11th February by President Donald Trump of a 25% tariff on all steel imports into the USA (and the consequent prospect of surplus steel being exported to other markets such as Europe and the Middle East) reinforces this conclusion; and may even delay the onset of the global price recovery. For further discussion of likely impact of president Trump's steel trade restrictions, see our analysis of the impact of Trump tariffs.

For MCI's projected monthly steel prices in 2025 and beyond, see our our steel price projections page.

Metals Consulting International Limited

February 18th, 2025